The marketplace encompasses therapeutic monitoring and

companion diagnostics, supporting healthcare experts in assessing treatment responses and figuring out patients' specific treatment plans. Emphasizing precision and personalized medication, the marketplace identifies unique biomarkers, genetic mutations, and molecular signatures to tailor cancer treatment strategies for individual patients.

Biomarker discovery and validation are critical, serving as signs for early detection, prognosis, and treatment response. Comprehensive genomic profiling permits an in-depth knowledge of genetic alterations in most cancer development. The integration of

artificial intelligence enhances diagnostic accuracy and automates processes.

The global next-generation cancer diagnostics market is influenced by various factors, including rapid technological advancements in diagnostic technologies like next-generation sequencing, liquid biopsy, and molecular imaging, enhancing precision and patient outcomes.

The shift towards personalized medicine, driven by the identification of specific biomarkers and genetic mutations, significantly impacts the growth of this market. While the rising cases of cancer globally fuel the demand for advanced diagnostics, ongoing research focuses on biomarker discovery—an integral part of modern cancer diagnostics and treatment design, especially in

cancer immunotherapy.

Regulatory landscape changes, with agencies like the FDA and EMA, impact market entry and development timelines. Globalization prompts market expansion strategies, and the integration of artificial intelligence enhances diagnostic accuracy. Economic factors, including healthcare spending and reimbursement policies, influence market dynamics, alongside collaborations, patient awareness, and advocacy efforts.

Moreover, the competitive landscape of this market fosters innovation and influences the adoption of next-generation cancer diagnostics. Continuous monitoring is crucial as market dynamics evolve with ongoing developments in technology, healthcare policies, and global events.

The Next Generation Cancer Diagnostics Market is experiencing unprecedented expansion due to advances in technologies like liquid biopsy, artificial intelligence (AI), and

molecular diagnostics. Early cancer detection is essential, with these innovative treatments offering more precise, noninvasive cancer screening and increasing global market potential.

Collaborations between tech companies and healthcare providers are creating significant market dynamics. Major diagnostic firms are investing in R&D for testing platforms to create more precise diagnostic tools, leading to improved accessibility and affordability of healthcare. This partnership fosters increased accessibility.

As the global cancer burden rises, so too has demand for Next Gen Cancer Diagnostics risen exponentially. As personalized cancer therapies become more effective and patients and healthcare providers seek cutting-edge diagnostic solutions, there is great potential for growth opportunities in emerging markets and through targeted therapy development.

Key Takeaways

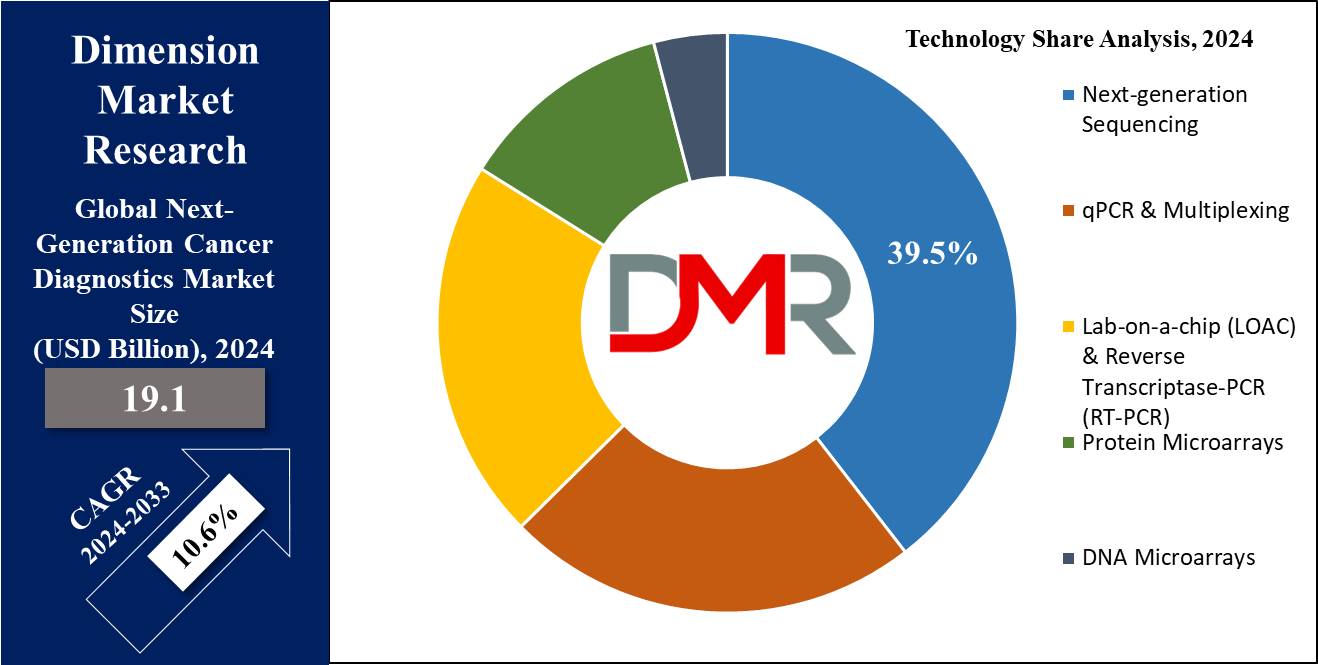

- Market Size: The next-generation cancer diagnostics market is projected to reach USD 47.2 billion in 2033 at a CAGR of 10.6% from a base value of USD 19.1 billion in 2024.

- By Technology Segment Analysis: Next-generation sequencing (NGS) is projected to emerge as a dominant technology in next-generation cancer diagnostics as it holds 39.5% of the market share in 2024.

- By Cancer Type Segment Analysis: Breast cancers are expected to dominate the cancer diagnostics market in the context of cancer type as they hold the highest market share in 2024.

- By Function Segment Analysis: Therapeutic monitoring plays a crucial role in next-generation cancer diagnostics, projected to dominate the function segment as it holds the highest market share in 2024.

- By Application Segment Analysis: Biomarker development is projected to dominate this market in terms of application as it will hold 42.2% of the market share in 2024.

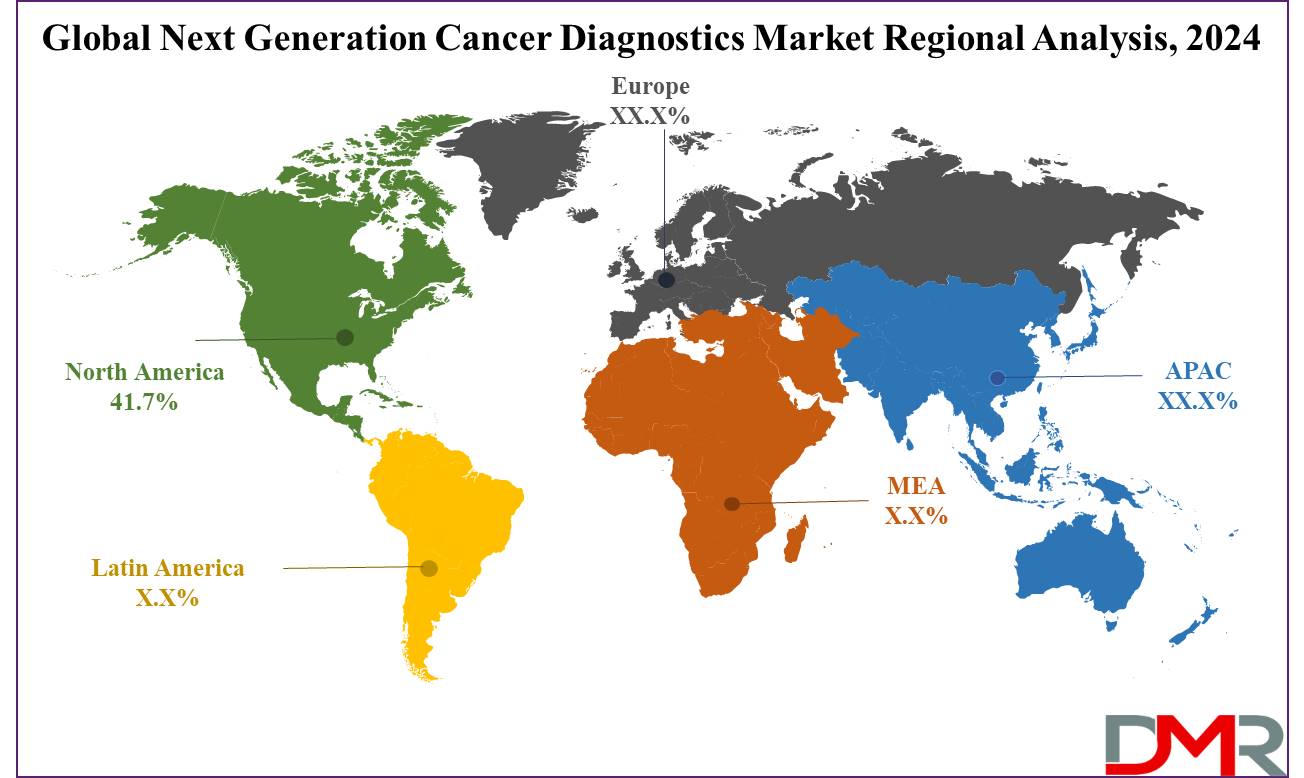

- Regional Analysis: North America is anticipated to dominate the global next-generation cancer diagnostics market as it holds 41.7% of the market share in 2023.

- While North America remains a dominant force, Other regions such as Europe and Asia-Pacific are experiencing growth in the adoption of next-generation cancer diagnostics.

Key Takeaways

- Early Detection: Next-generation cancer diagnostics allow early identification of cancer by advanced techniques like liquid biopsies and genomic sequencing, enhancing treatment outcomes and patient survival rates.

- Personalized Treatment: These diagnostics facilitate customized medicinal drugs by identifying unique genetic mutations and biomarkers, allowing for tailor-made treatment plans that target an individual's unique cancer profile.

- Monitoring Treatment Response: Advanced diagnostics provide real-time monitoring of an affected person's reaction to therapy, enabling changes to treatment plans based on the effectiveness, minimizing side effects, and improving effects.

- Predictive Analytics: Utilizing huge statistics and data mining, subsequent-gen diagnostics predict cancer recurrence and progression, helping in proactive management and timely intervention to save from relapse and complications.

Market Dynamic

Trends

Technological Advancements

The emerging cancer diagnostics market for the next generation is characterized by product innovation, which includes liquid biopsies and AI. Understanding these growth factors, it can be stated that these innovations are positioning the current market for cancer diagnostic and preventive methods at a new level and stimulating its development throughout the projected period.

Rising Cancer Cases

The rates of cancer incidence are on the rise globally with a proportionate influence on the current market standing. Higher incidence rates for new cancers are forcing the need for better diagnostic equipment, therefore supporting the growth of the global

cancer diagnostics market.

Growth Drivers

Government Initiatives and Funding

These factors can include government funding toward the research of different kinds of cancer or campaigns that help steer the market. Such strategies as the Global Breast Cancer Initiative Framework have endeavored to enhance cancer diagnosis and prevention, so such data support the next-generation cancer diagnostics market trends.

Growing Demand for Personalized Medicine

The advancements in cancer diagnosis are a result of the increasing support for personalized medicine. Similar to how patients are now demanding customized treatments that depend on their genomic traits, market stakeholders are offering accurate diagnostic tools, thereby catalyzing the market during the forecast period.

Growth Opportunities

Emerging Markets

The main strategic growth factors of the next-generation cancer diagnostics market are disclosed as emerging markets successfully offering numerous opportunities. Thus, with the right healthcare facilities and enhanced healthcare consumption, these regions have enough potential to help grow the global market for cancer diagnostics.

Development of New Biomarkers and Assays

Growing research on new cancer biomarkers and related assays can also be considered a profitable market benefit for its participants. They improve the identification of various cancers and help at an early stage, boosting the generation of cancer diagnostics market share & driving the market.

Restraints

High Costs of Advanced Diagnostics

The high cost that is par with the new generation of cancer diagnostic tools and procedures remains a constraint. Substantial when compared to other diagnostics, the costs of these products keep their availability reduced which in turn affects the potential market for these products.

Regulatory Challenges

The main threats in the market are centered on the regulatory environment and slow approval of new diagnostic products. These challenges can postpone the entry of innovative diagnostic products, which affects the market of next-generation cancer diagnostics and hence the growth of the global cancer diagnostics market.

Research Scope and Analysis

By Technology

Next-generation sequencing (NGS) has been projected to emerge as a dominant technology in next-generation cancer diagnostics as it holds 39.5% of the market share in 2024 and is anticipated to show subsequent growth in the upcoming period of 2024 to 2033.

The dominance can be attributed to its high throughput and parallel sequencing capabilities, enabling the simultaneous analysis of millions of DNA or RNA fragments, making it particularly advantageous for the complex genetic alterations often observed in cancer.

NGS allows for comprehensive genomic profiling by sequencing the entire genome or specific gene panels, facilitating the identification of mutations, copy number variations, and other genomic alterations relevant to understanding cancer biology.

The technology's sensitivity is crucial for detecting rare mutations and variants in a subset of cancer cells, aiding in the comprehension of tumor heterogeneity and informing personalized treatment strategies. NGS can also identify fusion genes and structural variations, providing valuable insights into the genetic mechanisms of cancer and guiding targeted therapies.

Additionally, the application of NGS in liquid biopsies offers a non-invasive means of monitoring cancer progression and treatment response. Ongoing advancements in NGS technologies, cost efficiency, scalability, integration with bioinformatics, and widespread adoption in research and clinical settings collectively underscore its vital role in unraveling the complexities of cancer genomes and guiding personalized treatment approaches.

By Cancer Type

Breast cancers are anticipated to dominate the cancer diagnostics market in terms of type, as they hold the highest market share in 2024 and are projected to have subsequent growth in the forecasted period of 2024 to 2033 as well.

Breast cancer dominates this segment as it has a high global incidence, prompting substantial research, diagnostic, and therapeutic efforts. Successful awareness campaigns emphasize early detection, fostering demand for advanced diagnostics, including next-generation technologies.

Advances in imaging technologies, combined with molecular diagnostics, enhance accuracy in breast cancer detection. Significant research investments support innovative technologies and biomarker discovery. The

precision medicine trend tailors breast cancer treatment based on individual characteristics, with next-generation diagnostics identifying specific biomarkers and genetic mutations.

Hormone receptor testing benefits from genomic and proteomic analyses, providing comprehensive subtype information. Next-generation diagnostics align with the need for effective therapeutic monitoring in breast cancer patients.

Ongoing biomarker research facilitates early detection and personalized treatment. Screening programs, guidelines, and patient advocacy contribute to breast cancer's prominence, with collective efforts driving research, awareness, and innovation. As advancements extend to other cancers, the evolving landscape may focus on different malignancies based on scientific discoveries and clinical needs.

By Function

Therapeutic monitoring is anticipated to play a crucial role in next-generation cancer diagnostics, dominating the functional segment as it holds the highest market share in 2024 due to its impact on optimizing treatment efficacy and individualizing patient care. In therapeutic monitoring by tracking patients' responses over time, healthcare providers can adjust treatments in real-time, aligning with the trend of precision medicine in oncology.

The personalized approach minimizes side effects, detects early signs of treatment resistance, and enhances long-term patient management. Therapeutic monitoring also ensures compliance with treatment plans, allowing for timely interventions and facilitating early detection of treatment failure or disease progression.

Integration with companion diagnostics enhances precision and aligns with a value-based healthcare approach that prioritizes patient outcomes. Emphasized in research and development efforts, therapeutic monitoring continues to evolve, leveraging technological advancements and a deeper understanding of cancer biology to further optimize cancer treatment strategies.

By Application

Biomarker development is expected to dominate this market in terms of application as it holds 42.2% of the market share in 2024 and is anticipated to show subsequent growth prospects in the upcoming period of 2024 to 2033.

This dominance is primarily driven by the new trends in personalized medicine, in which treatments are specifically based on individual genetic profiles, emphasizing the importance of biomarkers in selecting targeted therapies for more effective cancer diagnostics and treatment. Biomarkers enable early cancer detection, improve outcomes, and are integral to monitoring treatment response and guiding personalized interventions.

Advancements in genomics and proteomics technologies, along with research and development focus, have facilitated biomarker identification. Regulatory support and precision oncology initiatives recognize their significance, while rising cancer incidence globally underscores the need for early detection.

Biomarkers also contribute to companion diagnostics, aiding in patient selection for targeted therapies. The dominance of biomarker development signifies its critical role in advancing next-generation cancer diagnostics and underscores the ongoing efforts for further innovation.

The Next Generation Cancer Diagnostics Market Report is segmented based on the following

By Technology

- Next-generation Sequencing

- qPCR & Multiplexing

- Lab-on-a-chip (LOAC) & Reverse Transcriptase-PCR (RT-PCR)

- Protein Microarrays

- DNA Microarrays

By Cancer Type

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Cervical Cancer

- Others

By Function

- Therapeutic Monitoring

- Companion Diagnostics

- Prognostics

- Cancer Screening

- Risk Analysis

By Application

- Biomarker Development

- CTC Analysis

- Proteomic Analysis

- Epigenetic Analysis

- Genetic Analysis

Regional Analysis

North America has historically dominated the global next-generation cancer diagnostics market and is further projected to dominate this market as it holds 41.7% of the market share in 2024 and is expected to show subsequent growth in the upcoming period of 2024 to 2033.

The region benefits from a robust research and development infrastructure, particularly in the United States, with numerous biotechnology and pharmaceutical companies actively investing in innovative cancer diagnostics technologies. The advanced healthcare systems in the United States and Canada facilitate the rapid integration of new diagnostic technologies.

The well-established regulatory framework, led by the U.S. Food and Drug Administration (FDA), sets rigorous standards for diagnostic technology approval, ensuring high product quality and safety. North America provides funding and investment opportunities for companies involved in cancer diagnostics research and development.

Access to venture capital, private equity, and government funding supports the financial needs of innovative healthcare technologies. The region benefits from a high level of market awareness and acceptance among healthcare professionals and the general public regarding the importance of early cancer detection.

Additionally, global leadership in biotechnology, genomics, and molecular diagnostics by North American companies contributes significantly to shaping the global landscape of cancer diagnostics.

While North America remains a dominant force, other regions such as Europe and the Asia-Pacific are experiencing growth in the adoption of next-generation cancer diagnostics. Factors such as increasing healthcare infrastructure, rising awareness, and collaborations with global players contribute to the expansion of this market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape in the next-generation cancer diagnostics market is dynamic and characterized by key players such as Illumina, Thermo Fisher Scientific, Roche Diagnostics, Qiagen, and Bio-Rad Laboratories.

These companies offer a wide range of next-generation sequencing (NGS) and molecular diagnostic technologies. Continuous technological advancements aim to improve the accuracy, speed, and cost-effectiveness of cancer diagnostics, with a strong emphasis on research and development.

Strategic collaborations and partnerships are common in this market, where companies foster innovation through relationships between diagnostic companies, pharmaceutical firms, and research institutions.

Global market expansion is a priority, involving entry into new geographic markets and the establishment of partnerships with local distributors or healthcare providers. The trend toward personalized medicine is influencing the development of diagnostic tools that identify specific genetic mutations and biomarkers for tailored treatment strategies.

Mergers and acquisitions are prevalent, with larger companies acquiring smaller ones to access innovative technologies or strengthen their position in specific market segments. Compliance with regulatory standards, including approvals from regulatory bodies such as the U.S. FDA and European Medicines Agency, is critical. The market is influenced by healthcare infrastructure, reimbursement policies, awareness about early cancer detection, and economic factors like healthcare spending and budgets.

Some of the prominent players in the Global Next Generation Cancer Diagnostics Market are

- GE HealthCare

- Koninklijke Philips N.V.

- Novartis AG

- F. Hoffmann-La Roche Ltd

- Illumina, Inc.

- QIAGEN

- Agilent Technologies Inc. (Dako)

- Abbott

- Thermo Fisher Scientific Inc.

- Janssen Pharmaceuticals Inc.

- Other Key Players

Recent Developments

- In January 2023, QIAGEN initiated an exclusive strategic alliance with Helix intending to advance Next-Generation Sequencing (NGS) companion diagnostics for hereditary diseases. This collaboration capitalizes on the Helix Laboratory Platform, incorporating QIAGEN's biopharma connections, NGS capabilities, and worldwide regulatory proficiency. The collaborative solution is expected to gain momentum through patient recruitment for real-world evidence utilization and the delivery of diagnostic solutions through the integration of NGS and PCR technologies.

- In January 2023, the European Cancer Imaging Initiative was launched by the Commission in Brussels, aiming to support healthcare providers and researchers in utilizing innovative data-driven solutions for cancer treatment. As part of Europe's Beating Cancer Plan, it seeks to establish a secure digital infrastructure connecting cancer imaging data across the EU while maintaining high ethical standards and data protection. The initiative will foster collaboration between EU and national initiatives, hospital networks, and research repositories.

- In May 2023, Thermo Fisher Scientific and Pfizer announced a strategic collaboration aimed at expanding local access to next-generation sequencing (NGS) based testing for individuals facing breast and lung cancer in Latin America, the Middle East, Asia, and Africa. This initiative is expected to accelerate the examination of genes linked to diseases.

- In April 2023, ChromaCode revealed a partnership with Protean BioDiagnostics, a cancer diagnostic facility, to launch a non-small cell lung cancer test through an early access program. This test utilizes ChromaCode's high-definition PCR multiplexing technology, boasting a turnaround time of under 24 hours to identify all variations recommended by the National Comprehensive Cancer Network in a single assay. Requiring only 15 nanograms of input DNA and 5 nanograms of input RNA, the test has demonstrated a 99 percent concordance with next-generation sequencing.

- In June 2023, Devyser introduced two products, LynchFAP and BRCA PALB2, designed to provide precise and effective analysis of genes associated with an elevated risk of cancer. These kits guarantee performance accuracy for breast cancer, ovarian cancer, and Lynch syndrome.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 19.1 Bn |

| Forecast Value (2033) |

USD 47.2 Bn |

| CAGR (2024-2033) |

10.6% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Technology (Next-generation Sequencing, qPCR & Multiplexing, Lab-on-a-chip (LOAC) & Reverse Transcriptase-PCR (RT-PCR), Protein Microarrays, and DNA Microarrays), By Cancer Type (Breast Cancer, Lung Cancer, Colorectal Cancer, Cervical Cancer, and Others), By Function (Therapeutic Monitoring, Companion Diagnostics, Prognostics, Cancer Screening, and Risk Analysis), By Application (Biomarker Development, CTC Analysis, Proteomic Analysis, Epigenetic Analysis, and Genetic Analysis) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

GE Healthcare, Koninklijke Philips N.V., Novartis AG, F. Hoffmann-La Roche Ltd, Illumina Inc., QIAGEN, Agilent Technologies Inc., Abbott, Thermo Fisher Scientific Inc., Janssen Pharmaceuticals Inc., and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |