Market Overview

The Global

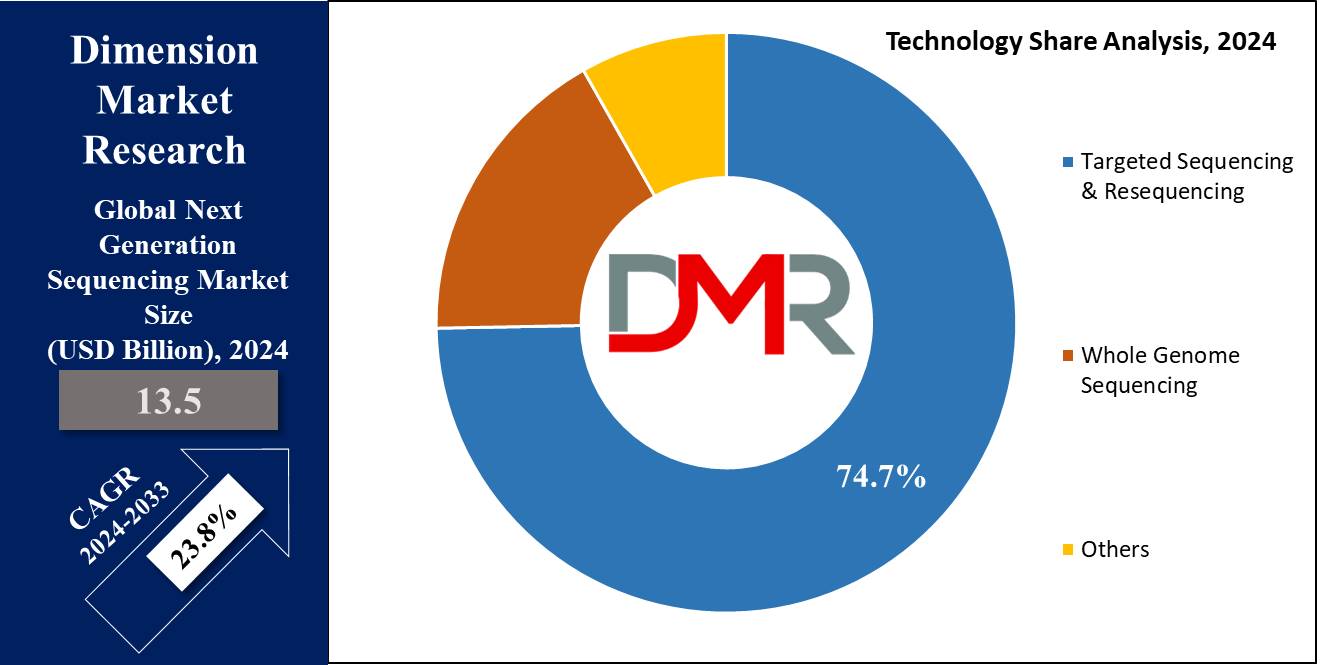

Next Generation Sequencing Market size is expected to hold a

market value of USD 13.5 billion in 2024 and is projected to show subsequent growth with a market

value of USD 92.2 billion by the

end of 2033 at a CAGR of 23.8%.

The global next-generation sequencing (NGS) market refers back to the enterprise concerned with the development of technologies, products, and offerings associated with high-throughput DNA and RNA sequencing on an international scale.

This market is experiencing tremendous growth, driven by advancements in technology, and rising applications in clinical diagnostics, personalized medicine, and research. This market consists of modern sequencing structures, consumables including reagents and sample training kits, and a wide array of programs ranging from oncology and scientific diagnostics to agriculture and studies.

With continuous technological improvements, the global NGS marketplace is playing a critical role in driving improvements in genomics research, customized treatments, and various scientific endeavors, making it a cornerstone inside the broader panorama of life sciences and biotechnology.

NGS allows for the simultaneous sequencing of lots to millions of DNA or RNA fragments, notably expediting the sequencing manner. This market's increase is inspired using factors consisting of studies and development initiatives, increasing applications, and the increasing integration of genomics into

healthcare and studies practices globally.

Market dynamics of the next-generation sequencing (NGS) market are formed by different factors, which include technological advancements, industry tendencies, regulatory landscape, and continuous improvements. Improvements in sequencing systems, pattern instruction kits, and data analysis tools contribute to elevated accuracy, speed, and cost-effectiveness. New developments in NGS technology, encompassing sequencing platforms and analysis equipment, contribute to advanced accuracy and cost-effectiveness.

New developments in NGS technologies, encompassing sequencing platforms and analysis tools, contribute to enhanced accuracy and cost-effectiveness. Efforts to reduce the overall cost of NGS procedures, including sequencing and data analysis, make the technology more accessible.

Cost reduction initiatives drive market expansion and adoption in various research and clinical applications. The broadening scope of NGS applications across genomics research, clinical diagnostics, and various industries fuels the market growth, with a notable focus on precision medicine and personalized treatment.

Key Takeaways

- Market Value: This market is expected to reach a market value of USD 92.2 billion in 2033 rising from the projected base value of USD 13.5 billion at a CAGR of 23.8% according to Dimension Market Research.

- By Technology Segment Analysis: Based on technology, the targeted sequencing and resequencing technology segment is projected to hold the majority with a 74.7% revenue share in 2024.

- By Product Segment Analysis: In the context of products, consumables are anticipated to secure a significant market share, exceeding 68.0% in 2024.

- By Application Segment Analysis: Oncology is projected to have the highest market share in the context of the application of next-generation sequencing in 2024.

- By End User Segment: Academic research institutions are projected to dominate the global next-generation sequencing market with the highest market share in 2024.

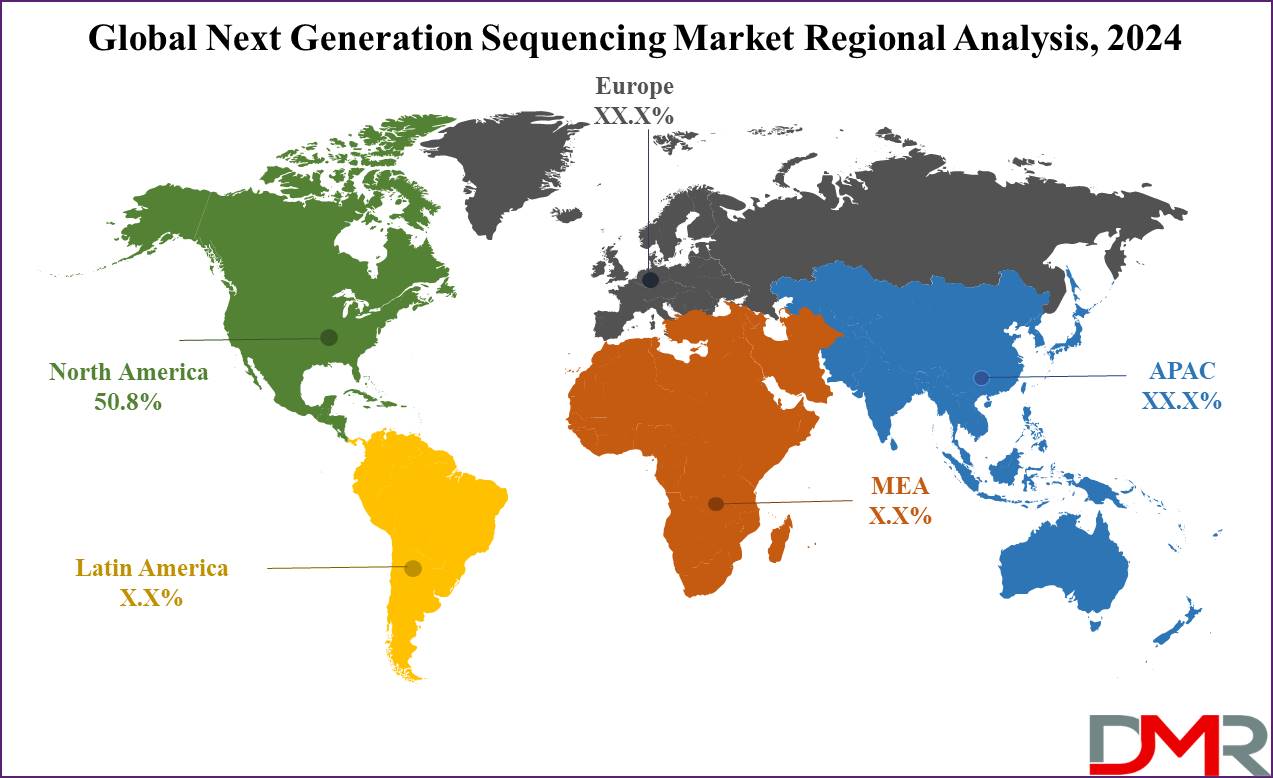

- Regional Analysis: In terms of geographical distribution, the North American region is projected to led with a substantial revenue share of over 50.8% in 2024.

Use Cases

- Oncology Diagnostics and Screening: NGS allows precise cancer diagnostics using identifying genetic mutations, helping in early detection, treatment selection, and monitoring of cancer development and response to therapy.

- Infectious Disease Research: NGS helps with the identification and characterization of pathogens, improving our understanding of microbial diversity, outbreak monitoring, and development of targeted treatment for infectious diseases.

- Reproductive Health: NGS is used in non-invasive prenatal testing (NIPT) to locate chromosomal abnormalities, microdeletions, and single-gene disorders, making sure early and correct analysis of fetal genetic conditions.

- Consumer Genomics: NGS lets individuals get admission to private genetic facts for ancestry monitoring, fitness chance assessment, and personalized lifestyle guidelines, promoting proactive health management.

Market Dynamic

Trends

Advancements in NGS TechnologiesNew advanced technologies like SBS and semiconductor sequencing make up one of the leading trends in the market. The following have gone a long way in helping to bring the cost of sequencing down thereby making it possible to be used in different fields.

Whole exome sequencing and long-read sequencing are also emerging as instances of market growth. It is predicted that with the development of NGS technologies, they will supplant Sanger sequencing in many applications and thus will foster the development of the next-generation sequencing market.

Increased Adoption in Clinical DiagnosticsThe

pharmaceutical and biotechnology industries are incorporating NGS technology for the implementation of the concept of personalized medicine, cancer genomes, and rare diseases. The use of NGS testing is gradually increasing as it offers an exhaustive report that is useful for diagnostic purposes as well as treatment strategies. It is predicted that this trend will continue to drive the market further as NGS integration increases in clinical practice as a method of diagnosis.

Growth Drivers

Rising Demand for Personalized MedicineThe availability of personalized medicine appears to be one of the most compelling factors that boost the global next-generation sequencing market.

Biopharmaceutical companies are now using NGS to advance the creation of personalized medicine with targeted treatment plans according to patients’ heredity.

It also increases the chances of treatment success and decreases unfavorable outcomes; in this way, NGS technologies are in great demand. The advancement of the market is boosted by the requirement of specific anthropology knowledge which is delivered by NGS and consequently allows for more specific treatment.

Technological Advancements and Cost Reduction

Next-generation sequencing technologies including SBS & semiconductor sequencing have brought down the cost of DNA sequencing to a great extent. The diffusion of costs for sequencing has reduced and opened new possibilities for the use of NGS in research and clinical diagnoses.

The relatively inexpensive cost coupled with high throughput and accuracy is what is propelling the use of NGS. Another advantage of the decrease in the cost of sequencing is in large-scale genomic projects, and routine clinical diagnosis, which are contributing to the development of the next-generation sequencing market.

Growth Opportunities

Expanding Applications in Research and Healthcare

The use of NGS products and sequencing services for genomics, transcriptomics, and epigenomics initiatives is on the rise. Today, NGS is most commonly employed for diagnostics at the beginning of the disease, prenatal diagnostics, and individualized oncology.

Faster development of the next-generation sequencing market in these sectors indicates sustainable business opportunities for the players. Another significant factor making this market grow is the fact that pharmaceutical and biotechnology organizations have integrated NGS to come up with new therapeutic targets and biomarkers.

Emerging Markets and Technological Integration

The developing countries offer a large market for the development of NGS technologies. Healthcare infrastructural development and better knowledge of genomics in the developing parts are key drivers of the market in question.

Also, the combining power of NGS with other technologies which include AI and ML handling NGS data augments the applicability and productivity of sequencing. This combination of technology proves to be a strong prospect for the growth of the next-generation sequencing market as it helps in conducting more detailed genetic analysis.

Restraints

High Initial Investment and Technical Challenges

While the costs have decreased to accommodate sequencing, the initial necessity of acquiring multiple NGS instruments as well as the necessary infrastructure is still substantial. Thus, small and mid-size laboratories might experience difficulties in obtaining advanced sequencers and NGS reagents.

Further on, the technical difficulty of NGS data analysis and the necessity to involve a highly qualified specialist can be mentioned as the barriers to implementation. Such factors may slow down the uptake and scale-up of integrated NGS technologies, especially in developing countries.

Regulatory and Ethical Concerns

The regulations and ethical issues that relate to the use of NGS in its various applications are some of the factors that slow down the market growth. With a focus on clinical diagnostics and individualized medicine, concerns of privacy, discrimination, and patient consent and/or authorization arise. The government bodies overseeing personal and clinical genomics research and practice are enforcing strict rules and guidelines on the safe and non-ethically questionable application of NGS technologies.

These regulations can affect the approval time of newly developed NGS products and services which in turn affects the market status of companies working in next-generation sequencing. To overcome these, regulatory and ethical issues are the key concerns that need to be managed to support the continued development of the market.

Research Scope and Analysis

By Technology

Targeted sequencing and resequencing technologies are projected to dominate this segment as they hold 74.7% of the market share in 2024 and are anticipated to show significant growth in the forecasted period of 2024 to 2033. It dominates the next-generation sequencing (NGS) market due to its cost efficiency and application specificity which enable researchers to focus on specific genomic regions, reducing overall sequencing costs and making genomics more accessible, especially for projects with budget constraints.

The depth of coverage achieved through targeted sequencing is crucial, providing accurate results in areas like cancer genomics where identifying low-frequency mutations is paramount. In clinical diagnostics and precision medicine, the precision of targeted sequencing shines, allowing them the identify disease-causing mutations and guide personalized treatment decisions.

By Product

In the context of products, Consumables is anticipated to dominate this segment as

they hold 68.0% of the market share in 2024 and are expected to show significant growth in the upcoming period of 2024 to 2033. The dominance of consumables can be attributed to sample preparation and target enrichment, which are indispensable components of NGS workflows.

They play a central role in processing biological samples, extracting nucleic acids, and preparing libraries for sequencing, ensuring the generation of accurate and reliable genetic data. Consumables are usually used in large quantities, requiring frequent replenishment, especially in high-throughput NGS laboratories.

The consistent demand for consumables contributes to a continuous revenue stream for manufacturers, making them a financially significant aspect of the market. Sample preparation consumables, such as DNA and RNA extraction kits, library preparation kits, and reagents, are critical for obtaining high-quality nucleic acids suitable for NGS. Researchers across various genomics applications, from basic research to clinical diagnostics, rely on these consumables to ensure the success of their experiments.

The consumables consist of a wide range of products, from basic reagents to specialized kits designed for specific applications. This diversity allows laboratories to customize their workflows based on their unique research goals, making consumables a central and flexible component of NGS experimentation. Consumables often have a lower per-unit cost compared to NGS platforms and instruments.

This pricing strategy encourages labs to invest in consumables regularly, ensuring a sustained revenue stream for manufacturers. The combination of customization, compatibility, and ongoing technological advancements further solidifies consumables as a central and continuously evolving component of the NGS market.

By Application

Oncology is expected to dominates this segment based on application as it holds a significant portion of the market share in 2024 and is expected to show noteworthy growth in the upcoming years of 2024 to 2033. One of the leading specialties that has immediately adopted the concept of precision medicine and adapts treatments to a patient’s particular genetic profile is oncology.

NGS entails the analysis of diseased tissue’s DNA in detail in order to discover specific gene alterations that cause cancer. This specificity is important when choosing specific therapies and prognosis of the treatment outcomes. Next-generation sequencing is widely applied in many clinical applications, particularly in oncology for diagnostics, and screening; both hereditary and sporadic.

It has an initial role in detecting the changes affecting tumor genome (sporadic cancer gene screening) and detects germline mutations that predispose a person to develop cancer (inherited cancer gene screening). One example of NGS application in oncology is the creation of companion diagnostics for choice of treatment based on the patient’s genome profile.

The advantage of high throughput which is characteristic of NGS comes in handy when there is massive genomic data analysis in academic and research-related endeavours in industries. Through Q-sequencing, NGS has introduced opportunities for tumor profiling based on gene mutation of somatic mutation, copy number changes, and structural rearrangements. This technology has assisted in increasing the knowledge of the biology of cancer.

By End User

Academic institutes are anticipated to dominate this segment in the NSG market as they hold the major portion of the market share in 2024 and are expected to show subsequent growth from 2024 to 2033. These institutes have long played a central role in driving the adoption of next-generation sequencing (NGS) technologies, particularly during the early stages of its development.

The dominance of academic research institutions in the NGS market can be attributed to several factors, like these institutions are renowned for their scientific research and technological innovation, making significant contributions to the development of NGS technologies. Academic researchers, fueled by a pursuit of knowledge and exploration of new frontiers in genomics, leverage NGS to conduct large-scale, high-throughput genomic studies, unravelling insights into genetics and related fields.

Moreover, academic research not only influences industry practices but also sets the stage for the development and application of NGS technologies in pharmaceutical and biotechnology. While academic research institutes have been primary drivers of NGS adoption, there is a growing trend of incorporating these technologies in other sectors such as clinical research, hospitals, and the pharmaceutical and biotech industries. The collaborative interplay between academia and industry continues to be a driving force in the growth of advanced genomics and NGS applications.

The Next Generation Sequencing Market Report is segmented on the basis of the following

By Technology

- Targeted Sequencing & Resequencing

- Whole Genome Sequencing

- Others

By Product

- Consumables

- Sample Preparation

- Target Enrichment

- Others

- Platform

By Application

- Oncology

- Diagnostics and Screening

- Oncology Screening

- Sporadic Cancer

- Inherited Cancer

- Companion Diagnostics

- Other Diagnostics

- Research Studies

- Clinical Investigation

- Infectious Diseases

- Inherited Diseases

- Idiopathic Diseases

- Others

- Reproductive Health

- NIPT

- Aneuploidy

- Microdeletions

- PGT

- Newborn Genetic Screening

- Single Gene Analysis

- Immune System Monitoring

- Metagenomics, Epidemiology & Drug Development

- Agrigenomics & Forensics

- Consumer Genomics

By End User

- Academic Research

- Clinical Research

- Hospitals & Clinics

- Pharma & Biotech Entities

- Others

Regional Analysis

North America is projected to dominate the global next-generation sequencing market as it

holds 50.8% of the market share in 2024 and is expected to show subsequent growth in the upcoming period of 2024 to 2033.

This region's dominance in the next-generation sequencing (NGS) market is rooted in several key factors, particularly the United States, which fosters a well-developed ecosystem hub for biomedical research and development, boasting leading institutions, universities, and biotechnology companies that have shown substantial advancements in genomics and sequencing technologies. The high adoption of NGS in healthcare settings, including clinical applications like genomic diagnostics, personalized medicine, and cancer research, has further solidified North America's standing in this market.

Key market players in next next-generation sequencing market such as Illumina, Thermo Fisher Scientific, and Pacific Biosciences have their headquarters here and have a significant presence in this region, significantly contributing to technological innovation and overall market growth. Government initiatives, notably from organizations like the National Institutes of Health (NIH), have played a pivotal role, allocating substantial resources to genomics projects utilizing NGS technologies.

North America's widespread integration of NGS into clinical applications, coupled with collaborative efforts and partnerships across various sectors, has fortified its leadership position. While North America remains a major player, it's essential to recognize the advancing strides in genomics research and NGS adoption in other regions such as Europe and Asia-Pacific, suggesting potential shifts in market dynamics over time.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global next-generation sequencing (NGS) market is characterized by a dynamic and competitive landscape featuring prominent players such as Illumina, Thermo Fisher Scientific, Pacific Biosciences of California (PacBio), BGI Group, Roche Diagnostics, Qiagen, Oxford Nanopore Technologies, Agilent Technologies, and PerkinElmer. The competitive landscape of this market is marked by continuous innovation, strategic collaborations, and acquisitions, reflecting the industry's commitment to improving sequencing technologies, reducing costs, and expanding applications in areas like clinical diagnostics and personalized medicine.

These companies have played pivotal roles in the development of advanced genomic sequencing technologies, offering a range of platforms and solutions widely used in research, clinical diagnostics, and genomics services. Illumina's NovaSeq and HiSeq series, Thermo Fisher Scientific's Ion Torrent sequencing platform, PacBio's long-read Sequel II system, and Oxford Nanopore's MinION and GridION systems are notable contributions to the field.

Some of the prominent players in the Global Next-Generation Sequencing Market are

- BGI Group

- F. Hoffmann-La Roche AG

- Pacific Biosciences of California Inc.

- Thermo Fisher Scientific Inc.

- Agilent Technologies Inc.

- Precigen Inc.

- Illumina Inc.

- Qiagen N.V.

- PerkinElmer Inc.

- PierianDx Inc.

- Other Key Players

Recent Developments

- In January 2024, Illumina launched a new high-throughput sequencing system aimed at reducing costs and increasing accessibility for clinical research and diagnostics. This launch is expected to enhance the adoption of NGS in personalized medicine and cancer research.

- In February 2024, Thermo Fisher Scientific introduced a new suite of NGS analysis software designed to streamline data interpretation and integration into clinical workflows. This development aims to address the complexity of NGS data and improve the accuracy of genetic testing.

- In March 2024, Qiagen announced a partnership with Helix to advance companion diagnostics for hereditary diseases. This collaboration aims to integrate Qiagen's QIAseq NGS technology with Helix’s population genomics expertise, enhancing the development of precise diagnostic tools.

- In March 2023, SOPHiA GENETICS revealed a new partnership with Qiagen. This collaboration involves combining QIAseq reagent technology with the DDM platform to enhance tumour analysis through next-generation sequencing (NGS). This partnership likely focuses on improving the accuracy and efficiency of tumour analysis for better diagnostics.

- In January 2023, QIAGEN announced a strategic partnership with Helix, a California-based population genomics leader. The collaboration aims to advance next-generation sequencing companion diagnostics specifically in the field of hereditary diseases.

- In September 2022, Illumina Inc. launched the NovaSeq X Series, which includes NovaSeq X and NovaSeq X Plus. These are new production-scale next-generation sequencers designed to offer faster, more powerful, and more sustainable sequencing. The advancements in technology aim to enhance the efficiency and capabilities of large-scale genomic sequencing.

- Thermo Fisher, Scientific introduced the CE-IVD-marked Ion Torrent Genexus Dx Integrated Sequencer in March 2022. This automated next-generation sequencing (NGS) platform is designed to deliver results in as little as a single day, providing a quick turnaround for NGS analysis. This technology likely plays a crucial role in expediting diagnostic processes.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 13.5 Bn |

| Forecast Value (2033) |

USD 92.2 Bn |

| CAGR (2024-2033) |

23.8% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Technology (Targeted Sequencing & Resequencing, Whole Genome Sequencing and Others), By Product (Consumables and Platform), By Application (Oncology, Clinical Investigation, Reproductive Health, Immune System Monitoring, Metagenomics, Epidemiology & Drug Development, Agrigenomics & Forensics and Consumer Genomics), By End User (Academic Research, Clinical Research, Hospitals & Clinics, Pharma & Biotech Entities and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

BGI Group, F. Hoffmann-La Roche AG, Pacific Biosciences of California Inc., Thermo Fisher Scientific Inc., Agilent Technologies Inc., Precigen Inc., Illumina Inc., Qiagen N.V., PerkinElmer Inc., PierianDx Inc, and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |

Frequently Asked Questions

The global next-generation sequencing market size is projected to account for USD 13.5 billion in 2024 and it is expected to reach around USD 92.2 billion by 2033.

The CAGR of the global next-generation sequencing market is 23.8%.

The prominent players operating in the global next-generation sequencing market are BGI Group, F. Hoffmann-La Roche AG, Pacific Biosciences of California Inc., Thermo Fisher Scientific Inc., Agilent Technologies Inc., Precigen Inc., Illumina Inc., Qiagen N.V., PerkinElmer Inc., PierianDx Inc. and others.

North America is anticipated to lead the global next-generation sequencing market as it holds 50.8% of the market share in 2024.