Market Overview

The Global

OLED Display Market reached a

value of USD 55.1 billion in 2023, and it is further anticipated to reach a market

value of USD 207.0 billion by 2033 at a

CAGR of 14.1%. The market has seen a significant increase in the recent past and is predicted to grow significantly during the forecasted period as well.

Organic Light-Emitting Diode (OLED) technology uses organic molecules in LEDs to generate light, resulting in high-end display panels. Constructed with organic thin films sandwiched between conductors, OLED displays emit vibrant light when an electric current is introduced. This straightforward design offers numerous advantages over alternative display technologies.

Further, the OLEDs have captured a significant interest from the global scientific and industrial domains over time. Also, diverse OLED variants have emerged in several industries, mainly focusing on both passive and active-matrix applications of the market across the world. These applications have helped OLED technology make inroads into adjacent sectors like the

3D Display Market and the Industrial Display Market, where advanced visuals and flexible designs are becoming increasingly important.

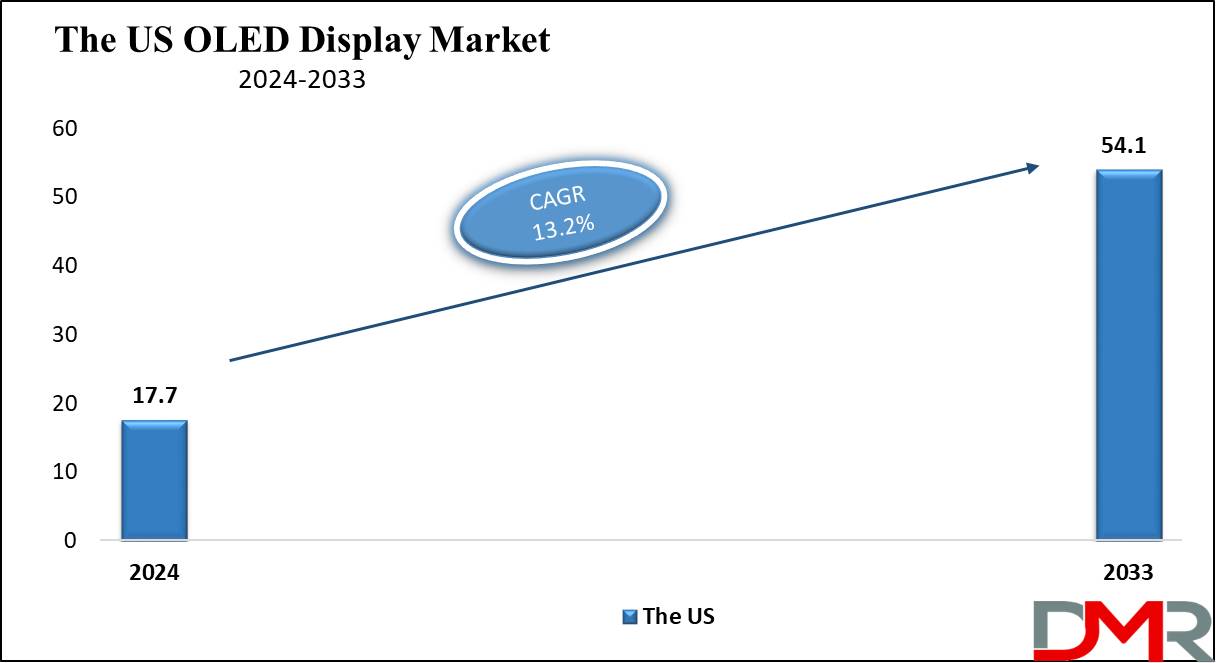

The US OLED Display Market

The US OLED Display Market is expected to

reach USD 17.7 billion in 2024 at a

CAGR of 13.2% over the forecast period of 2024 to 2033.

The US OLED display market is driven by the high demand of consumers for premium smartphones, TVs, and wearables, due to OLEDs' superior image quality and energy efficiency. In addition, development in flexible and foldable displays driver growth. However, high production costs and durability issues, like burn-in and shorter lifespans, act as significant restraints, limiting wider adoption and expecting challenges for manufacturers to balance cost and performance.

Further, in the US, the growth opportunity depends on the expanding applications of flexible and foldable displays, which can revolutionize device design and functionality. Meanwhile, a major trend is the higher integration of OLED technology in automotive and industrial sectors, with OLED displays being used for advanced dashboards and control panels, providing superior clarity and flexibility, thus expanding the market beyond traditional consumer electronics

Key Takeaways

- Market Growth: The OLED Display Market size is expected to grow by 135.9 billion, at a CAGR of 14.1% during the forecasted period of 2025 to 2033.

- By Component: AMOLED (Active-Matrix Organic Light-Emitting Diode) are expected to lead in 2024 with a major & are anticipated to dominate throughout the forecasted period.

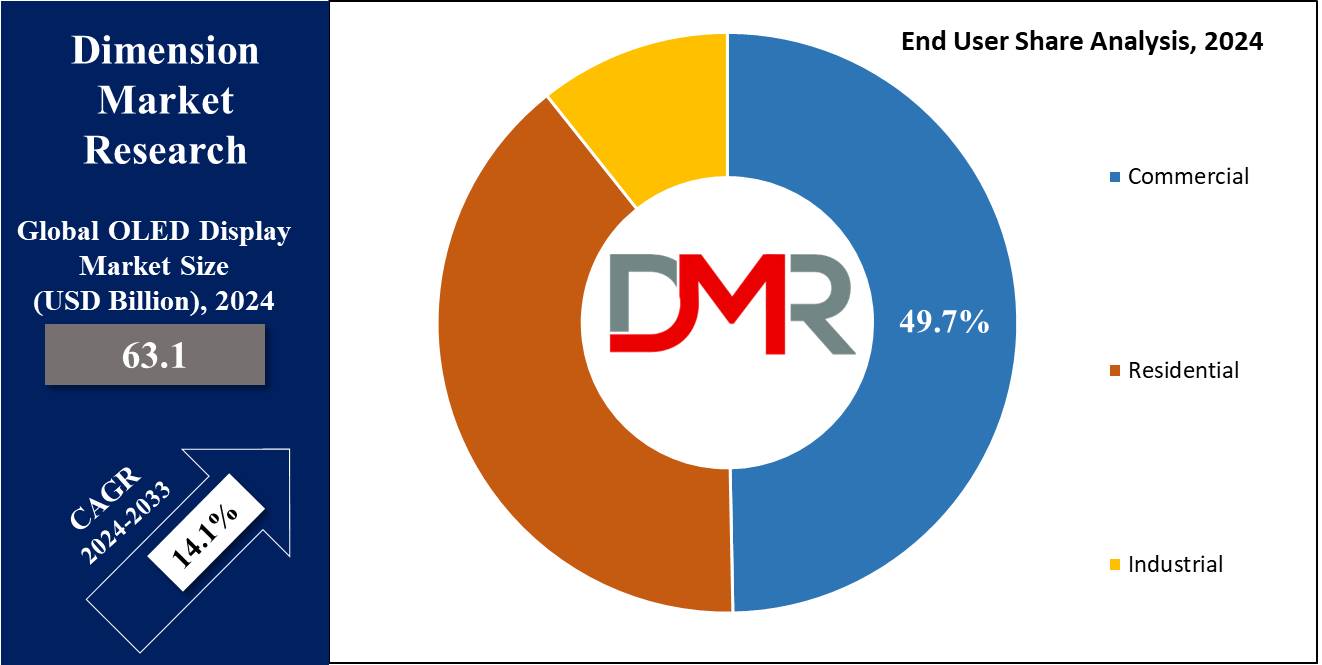

- By End User: The commercial sector is expected to lead the OLED Display market in 2024.

- By Industry Vertical: Consumer electronics are expected to get the largest revenue share in 2024 in the OLED Display market.

- Regional Insight: Asia Pacific is expected to hold a 36.8% share of revenue in the Global OLED Display Market in 2024.

- Use Cases: Some of the use cases of OLED Display include automotive displays, wearable devices, and more.

Use Cases

- Consumer Electronics: OLED displays are broadly used in smartphones, tablets, and smartwatches due to their high contrast ratios, vibrant colors, and thin form factors, which allow better designs and superior image quality.

- Television and Monitors: OLED technology is used in high-end TVs and computer monitors, providing excellent picture quality with deep blacks and broad viewing angles, improving the viewing experience for movies, gaming, and professional work.

- Automotive Displays: OLEDs are highly used in car dashboards, infotainment systems, and head-up displays (HUDs), providing flexible design options and better readability under many lighting conditions. These applications are driving integration across both the Industrial Display Market and the Electronic Display Market.

- Wearable Devices: OLED displays are ideal for fitness trackers, smart glasses, and other wearable gadgets due to their lightweight, energy-efficient, and flexible nature, which improves usability and comfort.

Market Dynamic

Driving Factors

Increasing Adoption in Consumer ElectronicsThe increase in demand for high-quality displays in smartphones, tablets, laptops, and TVs is a major driver. Consumers prefer OLEDs for their superior image quality, thinner form factors, and better energy efficiency compared to traditional LCDs.

Expanding Applications in Automotive and Wearables

The use of OLED displays is expanding beyond traditional consumer electronics into automotive dashboards, infotainment systems, and various wearable devices, which supports strong growth and drives innovation in OLED technology.

Restraints

High Production Costs

The manufacturing process for OLED displays is more complex and expensive compared to traditional LCDs, which results in higher production costs, which can limit their adoption, mainly in cost-sensitive markets and lower-priced devices.

Durability and Lifespan Issues

OLED displays can suffer from issues like burn-in and shorter overall lifespan, mainly for blue OLEDs. These reliability concerns can hinder broad adoption in certain applications that need long-lasting displays.

Opportunities

Advancements in Flexible and Foldable Displays

The development of flexible and foldable OLED displays provides major growth opportunities. These innovative designs can create new form factors for smartphones, tablets, and wearable devices, attracting consumer interest and driving market expansion.

Increased Adoption in Emerging Markets

As production costs decrease and technology improves, there is an increase in opportunity for OLED displays to penetrate emerging markets, which can lead to increased adoption in regions with rising disposable incomes and a growing demand for high-quality electronic devices.

Trends

Mini-LED and Micro-LED Integration

Current trends show a growing interest in combining OLED technology with Mini-LED and Micro-LED backlighting to enhance display performance, which focuses on improving brightness, contrast, and energy efficiency, providing superior visual experiences in consumer electronics and professional displays.

Increased Use in Automotive and Industrial Applications

There is a major trend towards incorporating OLED displays in the automotive and industrial sectors. OLEDs are being used in vehicle dashboards, HUDs, and advanced control panels due to their flexibility, clarity, and ability to operate under varying lighting conditions, which is expanding their market presence beyond consumer electronics.

Research Scope and Analysis

By Component

In terms of components, the OLED display market is categorized into AMOLED, PMOLED, and others, among these, the AMOLED (Active-Matrix Organic Light-Emitting Diode) plays a major role as a component in driving the market in 2024, as it is expected to hold a major share of revenue of the global OLED display market. Further, known for its vibrant colors, deep contrasts, & swift response times, AMOLED has captured consumer interest, mainly in smartphones and high-end displays. The evolution of AMOLED, marked by better energy efficiency and expanded applications, underscores its pivotal role in shaping the OLED display market's future trajectory.

By End User

The commercial sector has been a major driving force for the OLED (Organic Light Emitting Diode) market and will be doing the same in the coming future as well, as it is commercially employed in numerous ways, like that for vibrant displays in smartphones, TVs, and wearables.

Further improving automotive dashboards & lighting; creating eye-catching signage; visualizing health data in medical devices; powering high-quality graphics in gaming; contributing to attractive experiences in virtual & augmented reality and by providing compact & durable displays in aerospace; integrating into fashion and design projects; and offering soft, diffuse lighting solutions for architectural and interior applications.

By Industry Vertical

Consumer electronics is a major industry for the OLED (Organic Light Emitting Diode) display market and is expected to contribute significantly towards the global revenue of the OLED display market in 2024 as well as it is anticipated to maintain its pivotal position during the forecasted period, as it is mostly used in consumer electronics, like smartphones, tablets, laptops, and TVs, delivering vibrant and high-contrast displays with deeper blacks and faster response times.

Its flexible nature also allows curved & innovative screen designs, contributing to slim & stylish devices. Further, it is also anticipated to drive the market over the forecasted period as well. These consumer-driven advancements continue to influence the broader

Electronic Display Market trajectory.

The OLED Display Market Report is segmented on the basis of the following

By Component

By End User

- Residential

- Commercial

- Industrial

By Industry Vertical

- Automotive

- Consumer Electronic

- Healthcare

- Others

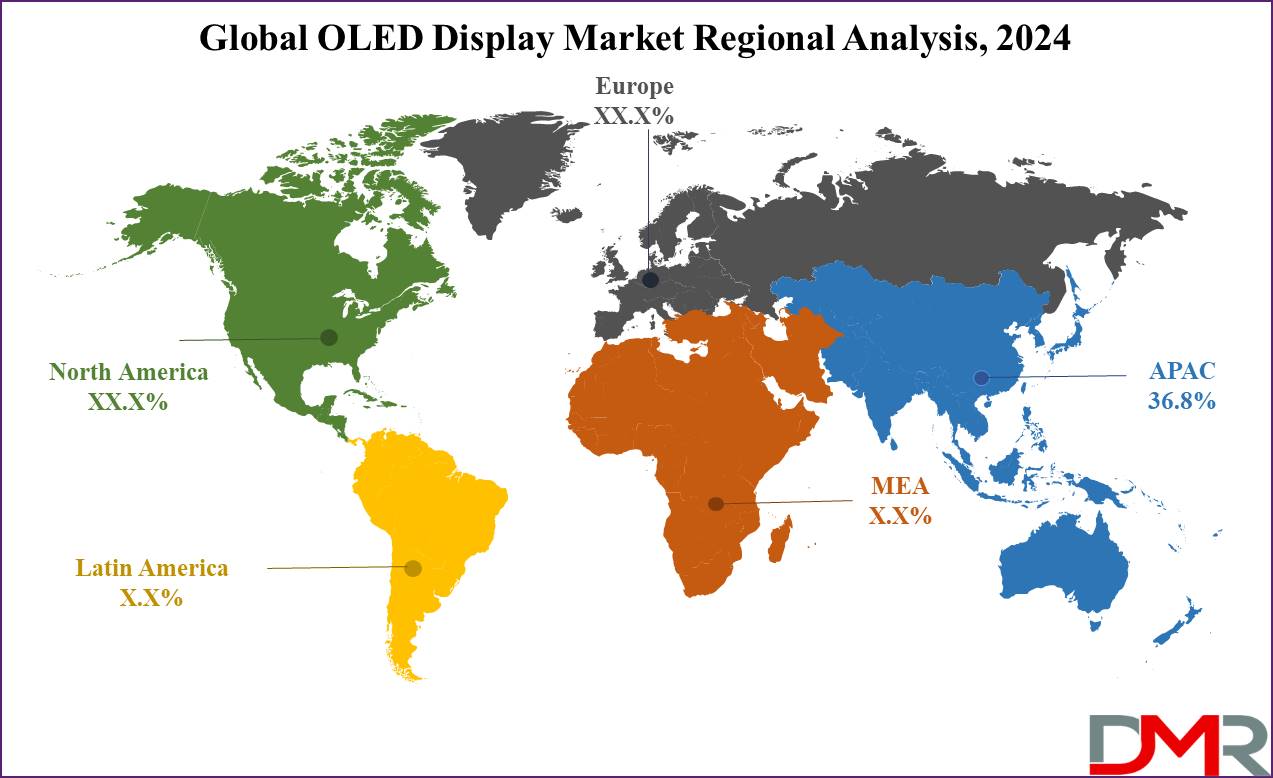

Regional Analysis

Asia-Pacific is expected to have a considerable market share,

accounting for over 36.8% of global revenue in 2024, and is further anticipated to dominate the market throughout the forecasted period. Further countries like China, Japan, and South Korea come out as the principal contributors to the Asia-Pacific market's revenue, which can be seen from the growth in R&D endeavors, major backing from both government & private sectors, and a growth in the presence of display material manufacturers and suppliers across the region.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The OLED Display market is quite a little fragmented, but still, the market notices strong competition driven by the presence of numerous players operating at both national and international levels. Furthermore, panel manufacturers are strategically allocating investments toward alternative technologies, intensifying the competitive dynamics among industry participants.

Some of the prominent players in the Global OLED Display Market are:

- Samsung Display

- LG Display

- BOE Technology Group

- Sony Corporation

- Universal Display Corporation

- AU Optronics

- TDK

- Pioneer

- Visionox

- WiseChip

- Other Key Players

Recent Developments

- In July 2024, LG launched its wireless M4 OLED TV on the heels of debuting its budget LG B4 OLED TV, which uses a design language similar to the current specs of the LG G4 OLED; instead, it uses LG’s Zero Connect Box for wireless connectivity, which is similar to Samsung’s wireless iteration in the One Connect box, found on select displays like its Neo QLED 8K, The Frame (2024), and Neo QLED 4K options among Samsung’s 2024 TV lineup.

- In May 2024, Apple announced its plans that the MacBook Pro with an OLED screen could be launched within the next couple of years. The company's Pro lineup has included its most powerful Apple Silicon processors for the past few years, and the launch of a MacBook with an OLED screen would offer vastly better picture quality in comparison to an LCD panel, albeit at a higher price.

- In May 2024, LG Display launched a large number of its next-generation OLED and cutting-edge display technologies at SID Display allowing visitors to experience new OLED technologies under the theme "A Better Future," varying from OLEDoS for VR to large-sized OLED panels that go beyond the limits of picture quality and automotive display solutions that are optimized for Software Defined Vehicles (SDV).

- In June 2023, Samsung announced the global launch of its Odyssey OLED G9, the latest in its series of Odyssey gaming monitors, which is the first OLED monitor to provide Dual Quad High Definition (DQHD; 5,120 x 1,440) resolution with a 32:9 ratio, said the South Korean electronics manufacturer.

- In May 2023, Samsung Display introduced the Rollable Flex, a breakthrough that seeks to transform the portability of tablet PCs and laptops. Additionally, they unveiled the Sensor OLED display, which integrates fingerprint and blood pressure sensors directly into panels, eliminating the need for separate modules. Through these and other pioneering OLED advancements, Samsung showcases its commitment to pioneering and spearheading new market segments.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 63.1 Bn |

| Forecast Value (2033) |

USD 207.0 Bn |

| CAGR (2024-2033) |

14.1% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

17.7 Bn |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (AMOLED, PMOLED, and Others), By End Users (Residential, Commercial and Industrial), By Industry Vertical (Automotive, Consumer Electronics, Healthcare and Others Industry Verticals) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Samsung Display, LG Display, BOE Technology Group, Sony Corporation, Universal Display Corporation, AU Optronics, TDK, Pioneer, Visionox, WiseChip, and Other Key Players |

| Purchase Options |

HVMN Inc., Thync Global Inc., Apple Inc., Fitbit Inc., TrackmyStack, OsteoStrong, The ODIN, Thriveport LLC, Muse, Moodmetric, and Other Key Players |

Frequently Asked Questions

The Global OLED Display Market reached USD 55.1 billion in 2023, which is further expected to reach USD 207.0 billion by 2033.

Asia Pacific is expected to dominate the Global OLED Display Market with a share of 36.8% in 2024.

The OLED Display Market in the US is expected to reach USD 17.7 billion in 2024.

Some of the major key players in the Global OLED Display Market are Samsung Display, TDK, Sony Corp, and many others.

The market is growing at a CAGR of 14.1 percent over the forecasted period.