Market Overview

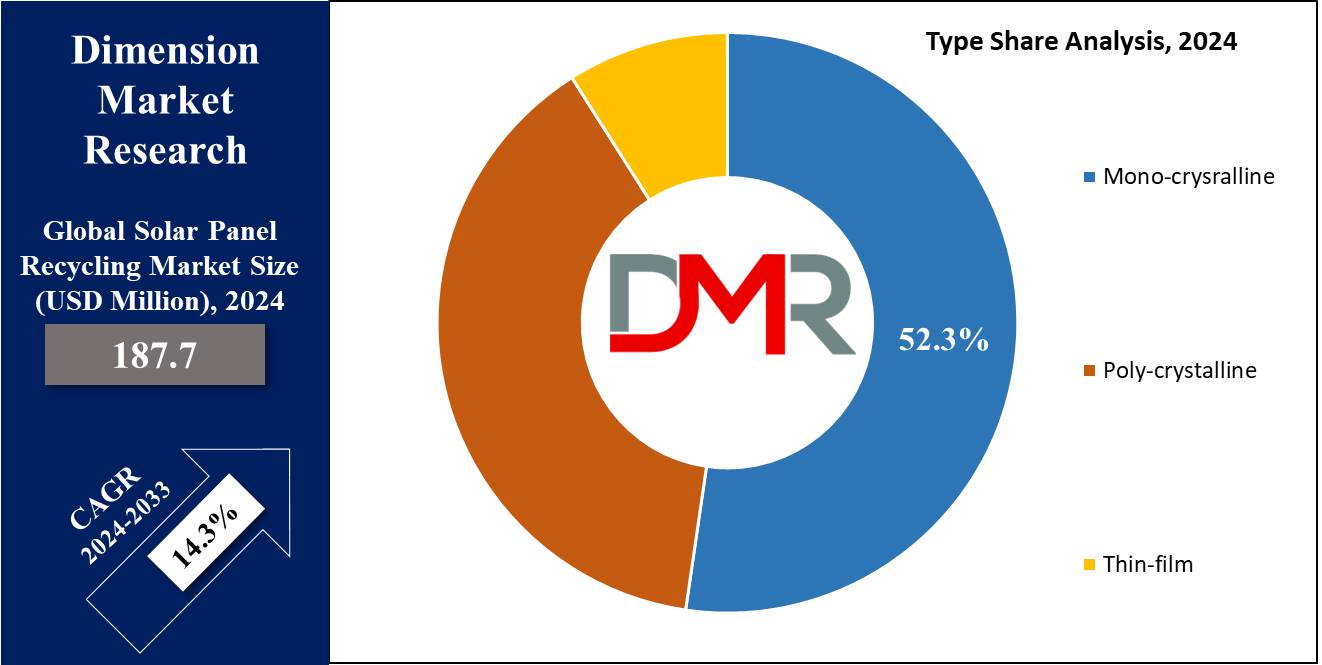

The Global Solar Panel Recycling Market is expected to reach a value of

USD 187.7 million by the end of 2024, and it is further anticipated to reach a market value of

USD 626.0 million by 2033 at a CAGR of 14.3%.

Solar panel use is growing globally, but with it comes the challenge of managing harmful materials like silicon, silver, and cadmium. Recycling has become critical to restraining waste and minimizing environmental risks.

From decommissioning to sorting, the process includes reusing materials and reducing greenhouse gas emissions. Manufacturers are now refining recovered materials for reuse, benefiting both the environment and the industry.

The growth in solar panel sales has caused an increase in waste, prompting the need for effective recycling methods, which not only reduce

health hazards but also lower the cost of new panels and create employment opportunities, as strict regulations and policies globally, along with high landfill expenses, are further driving the adoption of recycling practices.

Governments are endorsing solar projects and legalizing recycling processes, providing a major landscape for market expansion. Moreover, investments in R&D to recover rare metals are expected to drive market growth.

Key Takeaways

- Market Growth: The Solar Panel Recycling Market size is expected to grow by 414.1 million, at a CAGR of 14.3% during the forecasted period of 2025 to 2033.

- By Type: The mono-crystalline solar panel is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By Process: Mechanical process is expected to get the largest revenue share in 2024 in the Solar Panel Recycling market.

- By Shelf Life: Early Loss is expected to lead Solar Panel Recycling market in 2024

- By Application: Solar panel manufacturing are expected to get the largest revenue share in 2024 in the Solar Panel Recycling market.

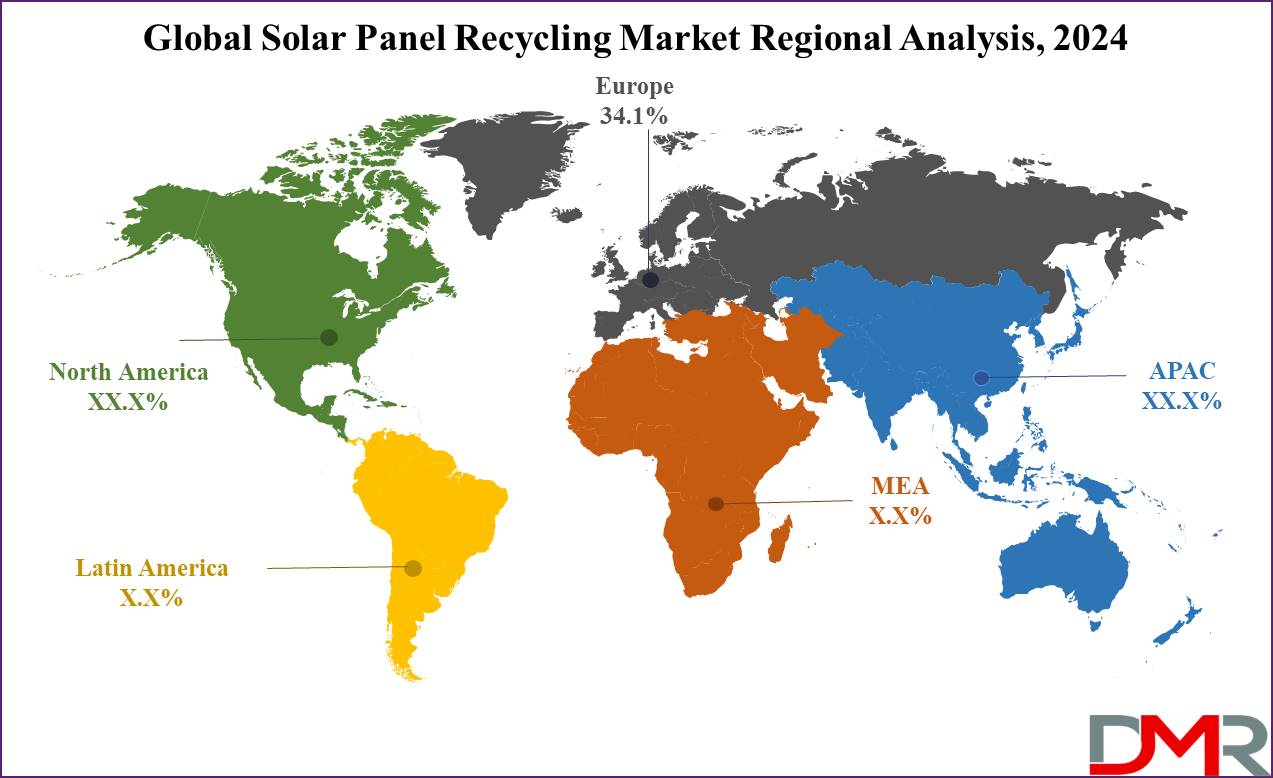

- Regional Insight: Europe is expected to hold a 34.1% share of revenue in the Global Solar Panel Recycling in 2024.

- Use Cases: Some of the use cases of Solar Panel Recycling include resource recovery, waste reduction, and more.

Use Cases

- Resource Recovery: Recycling solar panels allows for the restoration of valuable materials like silicon, and glass, and metals like aluminum and copper, which can be reused in manufacturing new panels or other products.

- Environmental Conservation: By recycling solar panels, one reduces the need for raw material extraction, reducing environmental damage associated with mining and processing, which supports conserving natural resources and reducing greenhouse gas emissions.

- Waste Reduction: Recycling solar panels protects them from ending up in landfills, where they can release toxic chemicals and take up valuable space. Proper recycling makes sure that these electronic waste components are safely managed and disposed of.

- Circular Economy Promotion: Using recycling in the lifecycle of solar panels supports the principles of a circular economy, where materials are kept in use for as long as possible, maximizing their value and minimizing waste generation, which promotes sustainability and resource efficiency in the solar energy sector.

Market Dynamic

Driving Factors

Rapid Expansion of Solar InstallationsThe push towards renewable energy across the world, along with the reduced costs of solar technology, has caused a major rise in solar installations across the world. As the number of solar panels in operation grows, there is also a rise in end-of-life panels requiring recycling, which creates an increase in demand for efficient and environmentally responsible recycling solutions.

Regulatory Initiatives and Sustainability Goals

Governments and regulatory bodies are implementing stricter waste management regulations and promoting sustainable practices in the solar industry. Various countries have launched extended producer responsibility (EPR) regulations, mandating manufacturers to manage the end-of-life disposal or recycling of their products. In addition, corporate sustainability goals and consumer preferences for eco-friendly products are driving manufacturers to adopt recycling initiatives, further driving the growth of the solar panel recycling market.

Opportunities

Technological Advancements

Current R&D in recycling technologies provides major opportunities for the solar panel recycling market. Innovations like enhanced sorting techniques, advanced chemical processes, and automated dismantling systems can improve the efficiency and affordability of recycling operations. Investing in these technologies can unlock new opportunities for growth in the recycling rate of solar panels and recovering valuable materials more effectively.

Emerging Secondary Markets

The recycling of solar panels not only develops raw materials for the manufacture of new panels but also opens up opportunities in secondary markets for recycled materials. These materials can be recycled for various applications, like construction materials, electronics manufacturing, and consumer goods.

Creating markets for recycled solar panel materials can develop additional revenue streams and contribute to the expansion of a circular economy in the solar industry. Moreover, with high consumer awareness and demand for sustainable products, recycled materials may provide a competitive advantage in the marketplace.

Restraint Factors

Lack of Comprehensive Recycling Infrastructure

One major restraint is the limited availability of infrastructure for solar panel recycling, mainly in regions with lower solar adoption rates. Developing an efficient and affordable recycling infrastructure requires high investment in collection, transportation, and processing facilities. The lack of such infrastructure can impact the scalability of solar panel recycling efforts and limit the market's growth potential.

Complexity and Cost of Recycling Technologies

Solar panels contain many materials, like silicon, glass, metals, and potentially toxic substances like cadmium and lead. Recycling these panels requires specialized technologies able to separate and process these components safely and efficiently.

The complexity of recycling processes, along with the high initial investment and operating costs of recycling facilities, can act as a challenge to market growth. In addition, the economic viability of recycling may be challenged by changes in commodity prices, making it difficult to justify the cost of recycling compared to raw material extraction.

Trends

Extended Producer Responsibility (EPR) Regulations

Various countries are implementing or strengthening EPR regulations, which need solar panel manufacturers to take responsibility for the end-of-life management of their products. These regulations mainly require manufacturers to establish take-back and recycling programs or contribute to collective schemes for recycling and disposal.

The growth of EPR frameworks globally is driving manufacturers to invest in sustainable product design and recycling infrastructure, thereby providing the growth of the solar panel recycling market.

Emergence of Innovative Recycling Technologies

There is a major focus on developing innovative recycling technologies customized specifically for solar panels. These technologies focus on improving the efficiency and environmental sustainability of the recycling process. Like, development in

robotic dismantling systems, chemical recycling methods, and closed-loop recycling processes are gaining importance within the industry.

These innovations not only improve the recovery of valuable materials from end-of-life panels but also address challenges related to harmful substances and reduce the carbon footprint of recycling operations.

Research Scope and Analysis

By Type

The mono-crystalline solar panel recycling product type is expected to dominate the revenue share in 2024. Despite their higher initial cost, monocrystalline panels are chosen for their superior heat resistance, extended durability, and exceptional efficiency, due to their composition of single-crystal silicon. Further, thin film solar panels are expected to experience the most rapid growth due to their commendable performance and affordability.

Also, major research and development efforts have resulted in the creation of lightweight, low-cost thin film modules supporting features like flexibility and temperature resilience. These advancements have supported the mass production of such panels, further improving their affordability and market appeal.

By Process

The Mechanical segment is projected to lead the solar panel recycling market in 2024, using its technique of physically dismantling solar panels into smaller components like glass, aluminum, and silicon for subsequent recovery and reuse, which is known for its affordability and simplicity, is favored for its capability to extract a major portion of valuable materials from the panels.

In addition, the Laser and Thermal segments are anticipated to experience significant growth in coming years driven by a rise in demand for high-purity silicon and the imperative for sustainable recycling practices for retired solar panels.

These segments meet the need for advanced and responsible recycling solutions, aligning with the industry's drive towards environmental stewardship and resource efficiency. With a higher focus on circular economy principles and regulatory pressures, these recycling methods are anticipated to play a major role in meeting the ongoing demand for solar panel recycling while optimizing resource usage and minimizing waste.

By Material

Silicon plays an important role in driving the growth of the global solar panel recycling market due to its importance as a primary material in solar panel manufacturing. As the key component of photovoltaic cells, silicon accounts for a major portion of the material composition in solar panels. The recycling of silicon from end-of-life panels is pivotal in mitigating the environmental impact of solar energy production and reducing the need for virgin silicon, thereby conserving natural resources.

Moreover, recycled silicon can be purified and restored into the manufacturing process, providing a sustainable and affordable alternative to virgin silicon, which not only promotes circular economy principles but also addresses concerns regarding resource scarcity and waste management.

In addition, the rise in the adoption of silicon-based solar technologies globally enhances the importance of efficient recycling practices to manage the increase in the volume of retired panels. As such, silicon emerges as an anchor in the solar panel recycling ecosystem, driving innovation, sustainability, and market growth while supporting the transition toward a more circular and resource-efficient solar industry.

By Shelf Life

The Early Loss segment is expected to have significant growth and revenue expansion in the coming future within the solar panel recycling market, which is primarily driven by higher demand for recycling services, attributed to the premature retirement of solar panels. With an increase in number of panels reaching the end of their operational lifespan, there's a high requirement for sustainable and accountable recycling solutions.

Such initiatives not only reduce waste accumulation and diminish the environmental footprint of solar energy production but also support the recovery of valuable materials and components important for the fabrication of new solar panels. As the industry experiences growth in decommissioned panels, the imperative for responsible recycling practices becomes vital, thereby driving the growth trajectory of the Early Loss segment within the solar panel recycling market.

By Application

Solar panel manufacturing acts as a major application driving the growth of the global solar panel recycling market throughout the forecasted period. With the higher expansion of the solar energy sector and the rise in the deployment of solar panels worldwide, there is a growth in the production of these panels.

As solar panels reach the end of their operational lifespan, there is a high need for responsible and sustainable disposal or recycling solutions. Manufacturers play a major role in this ecosystem, as they are not only the major producers of solar panels but also bear the responsibility of managing the end-of-life phase of their products.

By integrating efficient recycling practices into their operations, solar panel manufacturers can contribute to lower waste generation, conserving valuable resources, and reducing environmental impact. Furthermore, recycling enables manufacturers to recover valuable materials like silicon, glass, and metals from retired panels, which can then be reused in the production of new panels or other applications, which promotes circular economy principles, improves resource efficiency, and supports the continued growth and sustainability of the solar energy industry.

The Solar Panel Recycling Market Report is segmented on the basis of the following

By Type

- Mono-crystalline

- Poly-crystalline

- Thin-film

By Process

- Thermal

- Mechanical

- Chemical

- Combination

- Laser

By Material

- Silicon

- Metal

- Plastic

- Glass

- Others

By Shelf Life

By Application

- Solar Panel Manufacturing

- Construction

- Metal Industry

- Electronics & Semiconductor Industry

Regional Analysis

Europe is expected to hold the dominant position largest revenue share estimated at 34.1% in 2024, with further significant growth anticipated throughout the forecasted period, which is due to the region's high installed base of solar farms, which is expected to lead to a substantial increase in end-of-life solar panels in coming years, also there is a higher demand for solar panel recycling services. In Germany, market expansion is driven by technological advancements and stringent government regulations about waste management.

The rising adoption of solar panels as a sustainable alternative to conventional energy sources is expected to support product demand across Europe. Moreover, the Asia Pacific region is expected to witness the fastest growth, with China and Japan emerging as key revenue contributors.

Moreover, China, as a main, leads in patent filings for solar panel recycling, reflecting higher investments in R&D within the region. These factors collectively indicate a promising outlook for the solar panel recycling market in both Europe and the Asia Pacific region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global solar panel recycling market is characterized by a competitive landscape with many key players competing for market share, which offer a range of recycling services and technologies focused on recovering valuable materials from end-of-life solar panels. Competition is driven by factors such as technological innovation, cost-effectiveness, and environmental sustainability.

In addition, regulatory compliance and geographic reach play major roles in determining competitive positioning within the market. As the need for sustainable waste management solutions constantly rises alongside the expansion of the solar industry, competition among players is expected to intensify, driving further development in recycling processes and infrastructure.

Some of the prominent players in the Global Solar Panel Recycling Market are

- First Solar Inc.

- JA Solar Co. Ltd

- Canadian Solar Inc.

- Solarcycle Inc

- Trina Solar

- Yingli Energy Co Ltd.

- Hanwha Group Co Ltd.

- Reiling Group

- SunPower Corp.

- Echo Environment LLC

- Other Key Players

Recent Developments

- In March 2024, SOLARCYCLE announced plans to build a new facility to ensure crucial materials can be reused, as Georgia, will be home to the factory, which will come for USD 344 million.

- In March 2024, Iberdrola announced its plans to collaborate with commercial waste management company FCC Ámbito on efforts to promote the industrial-scale recycling of solar panels. Also, this company plans to monitor and potentially apply new treatment technologies to improve the industrial recovery capacity of PV modules and plan to explore the reuse of secondary raw materials obtained during treatment processes to ensure the complete recyclability of solar panels.

- In March 2024, Silfab Solar expanded its glass recycling partnership list by signing a new purchase agreement with Solarcycle to reach its sustainability goals, as per the agreement, Silfab will send its older or underperforming glass modules to Solarcycle for recycling. Further, SolarCycle will then sell the glass back to the company, which will use the recycled parts to produce its solar panels.

- In February 2024, Qcells announced a partnership with Solarcycle, a recycling company, as Qcells solar panels will be recycled after decommissioning. Further, the agreement is a landmark deal for solar recycling in the US. Also, it operates one of the largest solar manufacturing operations in the country, with plans to expand production to 8.4 GW per year by the end of 2024.

- In June 2023, Ørsted announced a partnership with SOLARCYCLE, a technology-based solar recycling company, to operate & recycle Ørsted’s end-of-life solar modules from its projects across the U.S, as it will assist Ørsted’s global commitment, effective immediately, to reuse or recycle 100 percent of solar panels that reach end-of-life status, a first-of-its-kind commitment in the industry.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 187.7 Mn |

| Forecast Value (2033) |

USD 626.0 Mn |

| CAGR (2024-2033) |

14.3% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Mono-crystalline, Poly-crystalline, and Thin-film), By Process (Thermal, Mechanical, Chemical, Combination, Laser), By Material (Silicon, Metal, Plastic, Glass, and Others), By Shelf Life (Normal Loss and Early Loss), By Application (Solar Panel Manufacturing, Construction, Metal Industry, and Electronics & Semiconductor Industry) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

First Solar Inc., JA Solar Co. Ltd, Canadian Solar Inc., Solarcycle Inc, Trina Solar, Yingli Energy Co Ltd., Hanwha Group Co Ltd., Reiling Group, SunPower Corp., Echo Environment LLC, and Other Key Players |

| Purchase Options |

Physio-Control Inc., Schiller, Medtronic, Abbott, Boston Scientific Corporation, Koninklijke Philips N.V., Zoll Medical Corporation, BIOTRONIK, Progetti Srl, LivaNova Plc, and Other Key Players |

Frequently Asked Questions

The Global Solar Panel Recycling Market size is estimated to have a value of USD 187.7 million in 2024 and is expected to reach USD 626.0 million by the end of 2033.

Europe is expected to have the largest market share in the Global Solar Panel Recycling Market with a share of about 34.1% in 2024.

Some of the major key players in the Global Solar Panel Recycling Market are First Solar Inc., JA Solar Co. Ltd, Canadian Solar Inc, and many others.

The market is growing at a CAGR of 14.3 percent over the forecasted period.