Market Overview

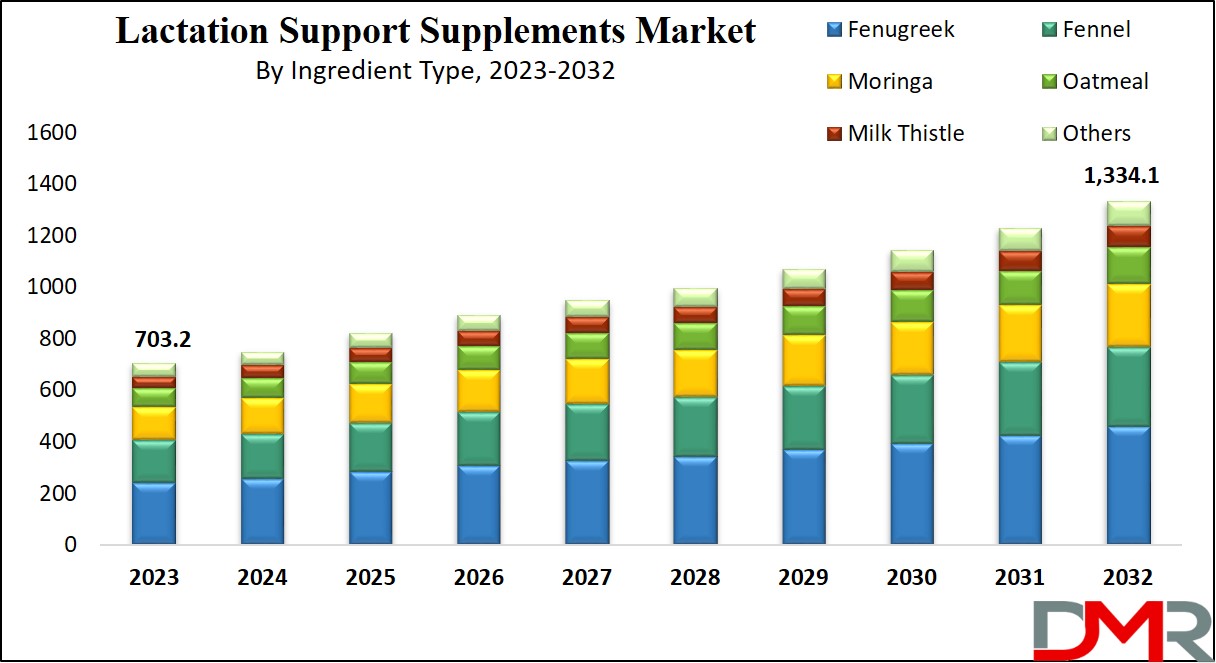

The Global Lactation Support Supplements Market is expected to reach a value of

USD 703.2 million in 2023, and it is further anticipated to reach a market value of

USD 1,334.1 million by 2032 at a

CAGR of 7.4%.

Lactation supplements come under the category of galactagogues, which are substances thought to boost milk supply in nursing individuals., as they come in different forms, like

pharmaceutical drugs & herbal or food-based options. A common approach includes using plant-based or botanical ingredients known for their properties believed to enhance milk production.

Key Takeaways

- By Ingredient Type, Fenugreek in 2024 & is anticipated to dominate throughout the forecasted period.

- In addition, Oatmeals are expected to have significant growth over the forecasted period.

- By Formulation, Capsules/tablets takes the lead & drives the market in 2024.

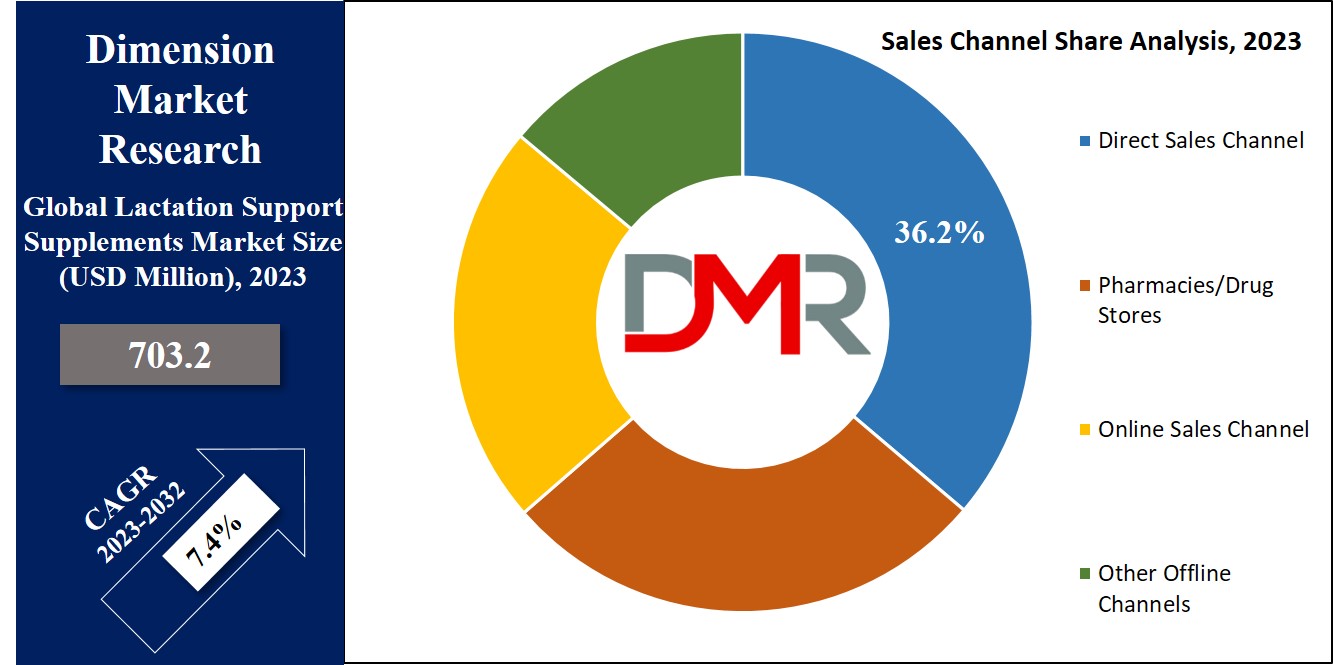

- By Distribution Channel, Direct Sales Channel accounts for a major revenue share in 2024

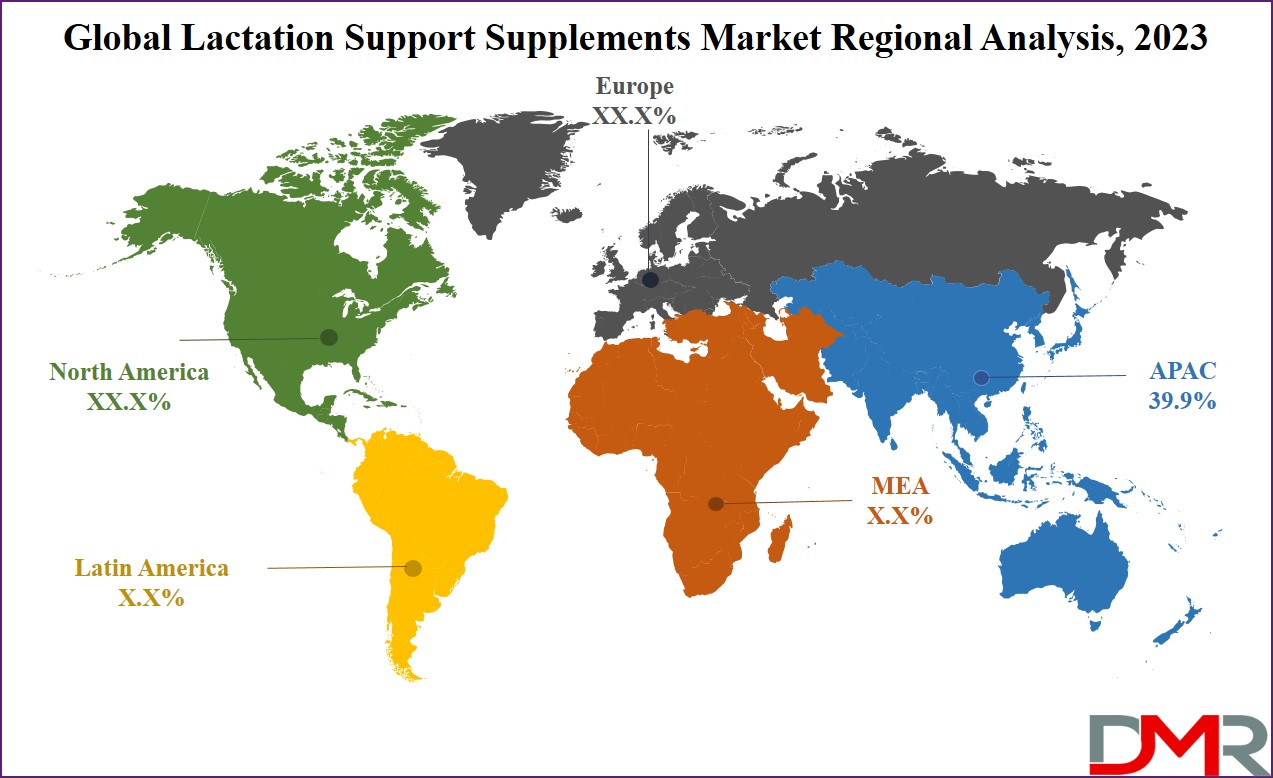

- Asia Pacific has a 39.9% share of revenue in the Global Lactation Support Supplements Market in 2024.

Market Dynamic

The need for lactation support supplements is driven by breastfeeding challenges faced by mothers, such as low milk supply or latch difficulties. These supplements, containing ingredients known to better milk production, offer a safe & convenient solution to overcome these obstacles, becoming an important resource for mothers looking to provide optimal nutrition for their infants. Also, the market demand is further fueled by the rising number of working mothers who, while balancing their professional careers with breastfeeding, looking for effective ways to maintain the milk supply.

In addition, lactation support supplements play a vital role in meeting this demand, providing a reliable & safe option for working mothers to improve lactation while managing work responsibilities.

However, challenges exist in maintaining the market need for these supplements, making sure consistent product quality & safety is critical, as any lapses can lead to consumer distrust. In addition, meeting regulatory compliance for dietary supplements creates a restraint, needing substantial resources & potentially impacting pricing & market accessibility. Navigating complex regulations may challenge manufacturers, affecting product launches and increasing compliance costs, potentially restraining market growth.

Research Scope and Analysis

By Ingredient Type

The Fenugreek category took the lead in revenue among lactation support supplements based on ingredient type in 2023. Fenugreek, an herb known for promoting lactation, is an essential component in these supplements, which stems from historical use as a natural way to enhance milk production in breastfeeding mothers. Also, in recent years fenugreek continues to be a preferred choice, aligning with the market's inclination towards natural & herbal ingredients, which reflects the need for safe & effective options, mainly among mothers looking for natural solutions to improve their breastfeeding journey & infant nutrition.

Moreover, the Oatmeal segment is expected to see significant growth in the coming years, which is a major ingredient with galactagogue properties is recognized for promoting milk production in breastfeeding mothers, and serves as a natural source of nutrients & dietary fiber, contributing to complete maternal

health. Also, current trends indicate a rise in popularity for oatmeal-based lactation supplements owing to their natural & wholesome appeal, resonating with consumers' preference for clean & plant-based ingredients.

By Formulation

The capsules/tablets category took the lead in the lactation support supplements industry in 2023, which is because most galactagogues, substances that promote milk production, are conveniently available in capsule or tablet form, which helps mask the strong smell & taste of herbal ingredients. Moreover, these capsules & tablets provide a correct dose, making it easier for breastfeeding women to use them effectively while reducing the risk of overdosing and potential side effects. These factors contribute highly to the large market share held by this segment.

Moreover, the liquid segment is anticipated to experience the fastest growth in the upcoming years, which is owing to the introduction of various liquid formulations, including flavored options to mask the taste & smell of the ingredients. Also, liquid products are user-friendly, easy to administer, and support high concentrations of active ingredients, making them effective in enhancing milk supply for lactating women.

By Sales Channel

In the lactation support supplements market, the majority of revenue came from direct sales in 2023, which means that companies sold their products directly to customers without middlemen, which often happened via the manufacturer's website or their physical stores. Further, the popularity of direct sales has grown because of the easy access & convenience provided by online shopping. Also, manufacturers are using their online presence to not only sell products but also to educate customers & provide personalized recommendations, making the direct-to-consumer experience more engaging and supporting brand loyalty.

Also, online sales are expected to grow the fastest in the coming years, which refers to buying lactation support supplements through online platforms & digital marketplaces. Further, it allows customers to easily explore, compare, and order these supplements, enjoying benefits like a broad product selection, user reviews, and home delivery. Due to the convenience, safety, & abundant information online, e-commerce platforms have become the go-to choose for consumers, which is predicted to continue, with strategies like digital marketing, influencer endorsements, & diversifying product offerings playing an essential role in boosting online sales of lactation support supplements.

The Lactation Support Supplements Market Report is segmented on the basis of the following:

By Ingredient Type

- Fenugreek

- Moringa

- Milk Thistle

- Fennel

- Oatmeal

- Others

By Formulation

- Capsules/Tablets

- Powder

- Liquid

- Others

By Sales Channel

- Online Sales Channel

- Direct Sales Channel

- Pharmacies/Drug Stores

- Other Offline Channels

Regional Analysis

Asia Pacific leads the way with the

highest share of 39.9% in 2023 in the lactation support supplements market, which is largely due to the broad use of these supplements among breastfeeding mothers in the region. Further, a study published in the PLOS ONE Journal found that more than half of breastfeeding mothers in Australia use galactagogues, with 47% opting for lactation cookies, 32% choosing brewer’s yeast, and 22% relying on fenugreek.

Further, the Middle East and Africa (MEA) region is expected to experience the fastest growth in the coming years, which is due to the growing cases of inadequate milk supply & a rising infant mortality rate in the region. Also, these factors are expected to drive the demand for lactation support supplements during the forecast period.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the global lactation support supplements market is dynamic, with several players competing for market share. Also, players employ strategies like product innovation, marketing initiatives, & partnerships to gain a competitive edge. The market also sees the entry of new players offering diverse products. Customer preferences, quality, and pricing play crucial roles in determining the competitive positioning of companies in this market.

In November 2023, Nestlé launched N3 milk, made from cow's milk with essential nutrients like proteins & vitamins, utilizing special technology, Nestlé reduced lactose & added prebiotic fibers, resulting in over 15% fewer calories. Further, clinical studies demonstrated that these fibers promote beneficial gut bacteria growth. Also, N3 milk is available in China, providing full cream & skimmed options with high protein support for healthy aging with added vitamins, minerals, and probiotics for bone health, muscle strength, and immunity.

Some of the prominent players in the global Lactation Support Supplements Market are:

- Nestle

- Pink Stork

- Mama’s Select

- NutraMarks Inc.

- Oat Mama

- Milky Mama

- Mommy Knows Best

- Mother Love

- Mommy’s Bliss Inc

- Maxi Health Research

- Other Key Players

COVID-19 Pandemic & Recession: Impact on the Global Lactation Support Supplements Market:

The COVID-19 pandemic and the associated economic recession significantly influenced the global lactation support supplements market. As, the pandemic's growth impact on health systems, economic uncertainties, & changes in consumer behavior have led to challenges & opportunities in this market. As the initial stages noticed disruptions in the supply chain & changes in consumer spending patterns, the growing awareness of health & well-being during the pandemic has fueled a growth in demand for lactation support supplements.

With more people prioritizing health, the market has witnessed an increasing interest in products that meet lactating mothers. The recessionary environment has allowed consumers to look for affordable & accessible solutions, impacting product preferences and market dynamics in the lactation support supplements sector.

Recent Development

- In July 2023, Danone developed Almimama, a probiotic supplement focusing on reducing mastitis incidence. Mastitis, inflammation in the breast, impacts one in four mothers, causing pain, flu-like symptoms, and engorgement. Also, breastmilk's recognized benefits for babies and mothers, as only 48% of infants under six months are exclusively breastfed, with issues like mastitis being a major barrier to sustained breastfeeding.

- In April 2023, Mother Dairy, India's top milk and milk product company, launched 15 new summer products created with consumer insights. Designed to cater to changing consumption habits and indulgence, the lineup contains a ready-to-eat Custard, 2 Cold Coffees, & over 10 Ice Cream variants, which focus on offering a delightful experience with these additions to its product range.

- In January 2023, Nutricia introduced Fortimel PlantBased Energy, its first plant-based oral nutritional supplement, personalized for those at risk of malnutrition due to illness, it's nutritionally complete with high-quality plant proteins from peas & soy. Suitable for vegan, vegetarian, and flexitarian diets, along with individuals with cow’s milk protein allergy. The launch aligns with the growing popularity of plant-based diets, with one-third of Europeans adopting a flexitarian approach.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 703.2 Mn |

| Forecast Value (2032) |

USD 1,334.1 Mn |

| CAGR (2023-2032) |

7.4% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Ingredient Type (Fenugreek, Moringa, Milk Thistle,

Fennel, Oatmeal, and Others), By Formulation

(Capsules/Tablets, Powder, Liquid, and Others), By

Sales Channel (Online Sales Channel, Direct Sales

Channel, Pharmacies/Drug Stores, and Other Offline

Channels) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Nestle, Pink Stork, Mama’s Select, NutraMarks Inc.,

Oat Mama, Milky Mama, Mommy Knows Best,

Mother Love, Mommy’s Bliss Inc, and Other Key

Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Lactation Support Supplements Market size is estimated to have a value of USD 703.2 million

in 2023 and is expected to reach USD 1,334.1 million by the end of 2032.

Asia Pacific has the largest market share for the Global Lactation Support Supplements Market with a

share of about 39.9%% in 2023.

Some of the major key players in the Global Lactation Support Supplements Market are Nestle, Pink

Stork, Mama’s Select, and many others.

The market is growing at a CAGR of 7.4 percent over the forecasted period.